Employers Should Strongly Consider Conducting Regular I-9 Internal Audits

Employers must verify the identity and employment authorization of all hired workers by completing Form I-9. Further, certain situations require employers to reverify work authorization, possibly many times throughout an employee’s career with the company. This process helps ensure that employers do not hire or retain unauthorized workers.

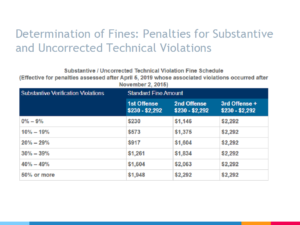

Although the Form I-9 is only a 2-page document, a variety of mistakes are often made. Form I-9 mistakes can quickly add up and lead to heavy civil fines if an employer’s I-9 forms are audited by U.S. Immigration and Customs Enforcement (ICE). In 2020, the Department of Homeland Security (DHS) released increased fines for form I-9 penalties, to account for annual inflation. The new fines became effective for penalties assessed after June 17, 2020 for associated violations which occurred after November 02, 2015. The updated fines are as follows:

Substantive/Uncorrected Technical Paperwork Violations:

- Minimum fine per violation for substantive paperwork or uncorrected technical violations: $234

- Maximum fine per violation for substantive paperwork or uncorrected technical violations: $2,332

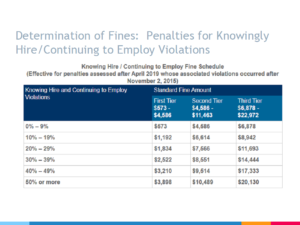

Knowingly Hiring/Continuing to Employ Unauthorized Workers:

- First offense fines: $583-$4,667

- Second offense fines: $4,667-$11,665

- Third or subsequent offense fines: $6,999-$23,331

Brief Overview of the I-9 Inspection Process

ICE begins the audit process by issuing a Notice of Inspection (NOI). The employer will only be provided 3 days to produce its I-9 forms for each employee. The purpose of a Form I-9 inspection is to identify any violations that might lead to criminal prosecution of an employer or identify either substantive or technical violations that might result in the issuance of an administrative fine or Warning Notice. The NOI typically will request all I-9 forms in the employer’s possession, including for both current and terminated employees. ICE will request payroll records for the last three years, list of current employees, and other corporate documents such as Articles of Incorporation and business licenses.

Thereafter, ICE will serve on the employer a “Notice of Technical or Procedural Failures” letter for any technical violations identified during the inspection process. ICE will provide the employer with marked copies of the I-9 forms that were found to have technical violations. The employer will then be given 10 business days to correct those forms. Any uncorrected technical violations will be treated as substantive violations. Further, unlike technical violations, actual substantive errors are not allowed to be corrected.

In situations where fines are warranted, a Notice of Intent to Fine (NIF) will be served along with charging documents specifying the violations committed by the employer and the associated fines for substantive violations and any uncorrected technical violations. Additional fines will be assessed if employers are determined to have “knowingly hire or continuing to employ unauthorized worker” violations.

Some examples of substantive and technical paperwork violations include:

Substantive Paperwork Violations:

- Failure to timely prepare Form I-9

- Failure to reverify employment authorization in a timely manner in Section 3 when required

- Failure by the employer to sign the attestation in Section 2 of Form I-9

- Failure by the employer to sign the attestation in Section 3 when reverification is required

- Completing a false Section 2 attestation such as when the certifier examines the documents outside the presence of the employee presenting them

- Failure by the employee to sign Section 1

- Failure to timely present Form I-9

- Failure to prepare Form I-9 for an employee

- Failure to correct technical errors after being served a Notice of Technical or Procedural Failures letter by ICE

Technical Paperwork Violations:

- Failure by the employee to list his or her maiden name, address, or birth date in Section 1

- Failure by the employee to include his or her “A” number if the box is checked in Section 1 indicating he or she is a permanent resident (will only be considered technical if the A number is included in Section 2 or on a copy of a document retained with the I-9, otherwise will be considered substantive)

- Failure by the employee to include his or her “A” number or admission number if the box is checked in Section 1 indicating that he or she is “an alien authorized to work” in the United States (will only be considered technical if the number is included in Section 2 or on a copy of a document retained with the I-9, otherwise will be considered substantive)

- Failure of the form’s preparer or translator to print his or her name, address, signature or date in the preparer’s certification box

- Failure by the employer to provide the title, business name, and business address in Section 2

How Fines Are Determined

ICE uses the charts above to determine a fine amount. The auditor will divide the number of violations by the number of employees for which a Form I-9 should have been prepared to obtain a violation percentage. This percentage provides a base fine amount depending on whether this is a first offense, second offense, or a third or more offense. The standard fine amount listed in the table relates to each Form I-9 with violations.

For example, regarding substantive and uncorrected technical violations, if an employer should have 100 perfect I-9 forms, but ICE identifies errors on 70 of them, the substantive error rate will be 70%. The same calculation is made to determine the error rate for knowing hire/continuing to employ violations. Once the error rate is calculated, ICE refers to a graduated scale for the fine amount.

As demonstrated on the chart for Substantive and Uncorrected Technical Violations, the scale begins at $230 for error rates from 0-9% and tops out at $1,948 for error rates at 50% or more for first-time offenders. In the example above, if the error rate is 70%, it would translate to a fine amount of $1,948 per violation. The total base violation for substantive errors would be $136,360 ($1948 x 70). ICE will then add the amount derived from knowing hires/continuing to hire to the amount derived from the substantive/uncorrected technical violations schedule.

(Please note, the charts above are currently on the ICE website, but do not currently reflect the increased fines for penalties assessed after June 17, 2020 for associated violations that occurred after November 02, 2015)

Additionally, once the base violation for substantive paperwork violations and knowing hire/continuing to employ is determined, ICE can then raise or lower the fine amount by 25% based on five factors:

- Size of the business;

- Good faith attempt to comply;

- Seriousness of the violations;

- Whether any unauthorized workers were found; and

- History of compliance.

Each of these five factors can cause the base fine level to be adjusted up or down by 5% for each factor or 25% total. In the example above, the final fine amount could range from $102,270 to $170,450.

ICE has been more forgiving of employers who have taken the necessary steps to correct inadvertent mistakes and implement improved I-9 policies and procedures prior to receiving a NOI. Therefore, employers should seriously consider conducting regular internal audits to ensure the company is prepared if ICE serves a Notice of Inspection.

How Reddy & Neumann Can Help

There are multiple issues to consider before conducting an I-9 internal audit. For example, employers should determine the appropriate purpose and scope of the I-9 audit. Specifically, an employer may choose to review all I-9 forms or a sample of its I-9 forms. If an employer chooses to review a sample of its I-9 forms, the selection process must be based on neutral and non-discriminatory criteria. Furthermore, an employer should consider how it will consistently address any deficiencies found on the I-9 forms. At Reddy & Neumann, our team provides employers with a variety of services related to I-9 compliance to help sort through these issues, including:

- A complete review or sampling of a company’s I-9 documents for technical, procedural and substantive errors;

- Guidance on lawfully correcting errors on Form I-9;

- An evaluation of the company’s I-9 and E-Verify profile including the company’s hiring processes and procedures;

- An evaluation of HR training requirements pertaining to I-9 and E-Verify compliance;

- An evaluation on the company’s record retention and storage policy to ensure compliance with federal requirements;

- Advice regarding the pros and cons of enrollment in E-Verify; and

- Representation in the event of a Notice of Inspection issued by ICE.

By: Krystal Alanis

Krystal Alanis is a Partner at Reddy Neumann Brown PC She acts as the Managing Attorney for the firm’s PERM Labor Certification Department, where she oversees all EB-2 and EB-3 employment-based green card matters. She also guides employers and individuals through the I-140 and Adjustment of Status process, assists clients with non-immigrant visa petitions (e.g. H-1B, TN, L-1, etc.), and advises her clients on I-9 compliance issues.